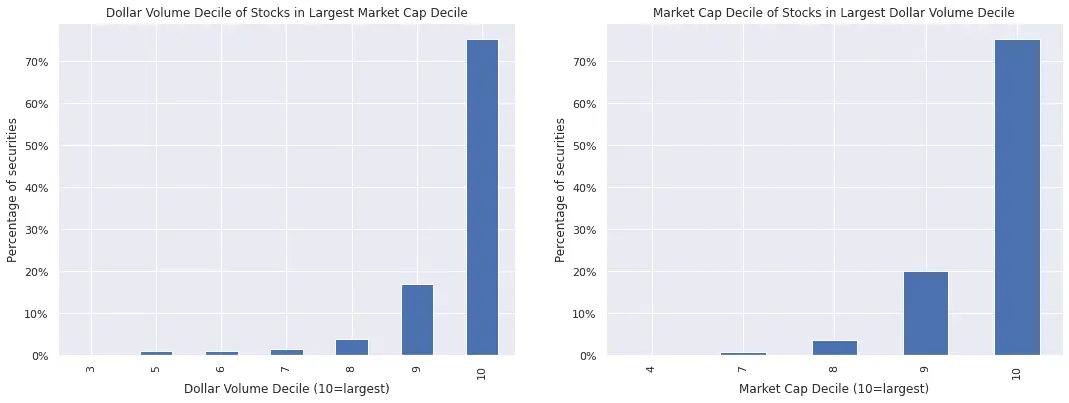

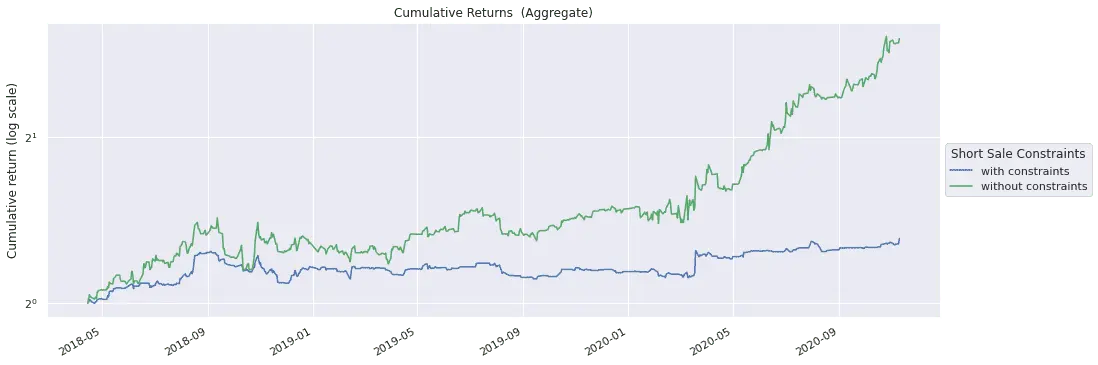

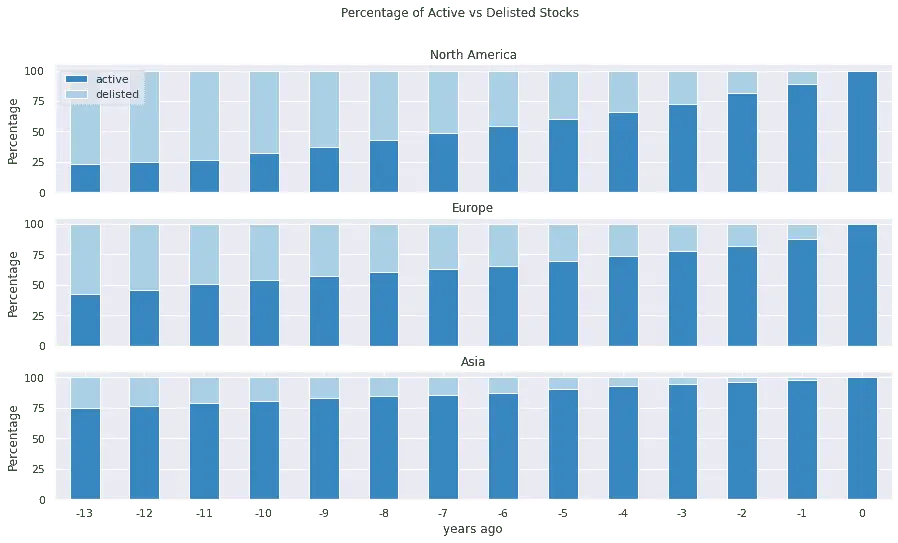

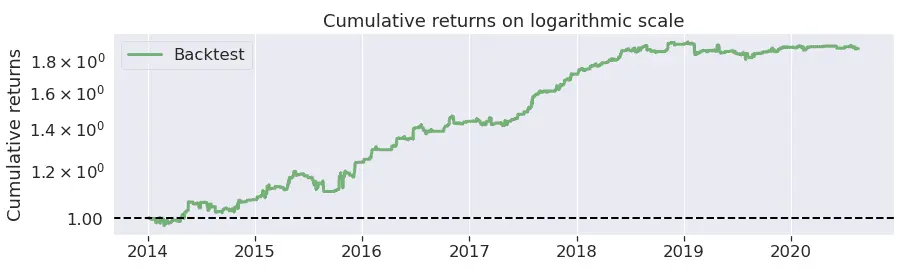

Market cap and dollar volume are two commonly used metrics for filtering a trading universe by size of security. Does it matter which one you use? In this post, I quantify the difference between market cap and dollar volume and explain the kinds of stocks that may unexpectedly appear in your universe with each metric.

Send a Message

Send a Message