What Comes After a Dead Cat Bounce?

Tue Dec 01 2020 by Brian StanleyWhat happens after stocks suffer large one-day losses? This post finds that the proverbial "dead cat bounce" occurs overnight and is followed by continued losses the next day. Targeting international markets, I explore a trading strategy that aims to profit from the losses that follow a dead cat bounce.

The timing of the dead cat bounce

Most traders are familiar with the "dead cat bounce": a temporary price recovery following losses, that is followed by more losses. But when does the bounce occur and when do the losses resume?

Using end-of-day price data for US stocks, I identify all stocks that suffered one-day losses of -10% or more.

prices = get_prices("usstock-1d", start_date="2018-01-01", end_date="2019-01-01", fields=["Close", "Open"])

closes = prices.loc["Close"]

opens = prices.loc["Open"]

big_losers = closes.pct_change() <= -0.10I then look at returns over the subsequent day, breaking them into overnight (close-to-open) and intraday (open-to-close) returns.

oc_returns = (closes - opens) / opens

co_returns = (opens - closes.shift()) / closes.shift()

oc_returns = oc_returns.where(big_losers.shift())

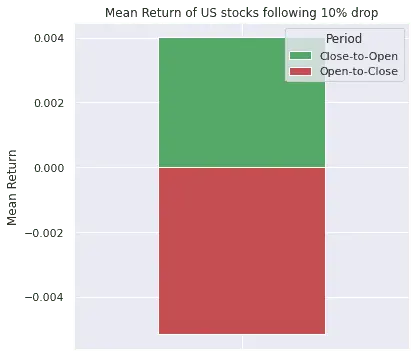

co_returns = co_returns.where(big_losers.shift())Plotting the returns reveals that stocks gain 40 BPS overnight, on average, following steep losses, but then lose over 50 BPS on average during the next day's session.

Trading challenges in the US stock market

The above analysis suggests two possible trading strategies when a stock falls 10% or more:

- "dead cat bounce" strategy: buy the stock at the close and exit the next morning;

- "dead cat drop" strategy: short the stock at the next morning's open and exit at the close

However, both of these strategies pose challenges. The challenge with buying at the close is that we are using the closing price to measure the 10% drop; by the time we know the stock satisfied our entry rule, it's too late to enter on the close. Instead, we would need to modify the strategy to use intraday data and enter on the close based on price drops measured shortly before the close. This is left as an exercise to the reader, as the remainder of this post will focus on the "dead cat drop" strategy idea.

The challenge with shorting at the next day's open is specific to the US market. 10% one-day declines trigger SEC Rule 201, also known as the alternative uptick rule or short sale circuit breaker. This rule, which is in effect on the day of the decline and on the following day, restricts short sales unless they occur at a price above the national best bid. This rule makes it unpredictable whether our orders will get filled and thus erodes our ability to trust backtest results.

Multi-country backtest of a "dead cat drop" strategy

SEC Rule 201 does not apply to international markets. So, I create a Moonshot strategy that shorts stocks in these markets following 10% declines, entering on the next day's open and holding until the close. Using survivorship bias-free data from EDI (available in the Data Library), I test the strategy on the 10 largest non-US markets that are shortable through Interactive Brokers:

- Belgium (Euronext Brussels)

- Canada (Toronto Stock Exchange)

- France (Euronext Paris)

- Germany (Xetra)

- Hong Kong (Hong Kong Stock Exchange)

- Japan (Tokyo Stock Exchange)

- Netherlands (Euronext Amsterdam)

- Sweden (Nasdaq Nordic Stockholm)

- Switzerland (Six Swiss Exchange)

- United Kingdom (London Stock Exchange)

Backtesting the strategy on these markets from 2007-2017, I obtain an aggregate Sharpe ratio of 1.3. The performance of individual markets varies, with Japan being the strongest-performing market with a Sharpe ratio of 1.1.

At this initial stage, I do not yet model transaction costs and short sale constraints. Omitting transaction costs makes it easier to determine whether the basic hypothesis is sound. Including such costs from the outset would make it impossible to distinguish between strategies that have no inherent alpha and strategies that have alpha that can't readily be captured for technical reasons. This distinction is useful to know. If the issue is technical, it may be possible to work around it, such as modifying a strategy that is sensitive to commissions to trade less frequently.

The purpose of a multi-country backtest

Running a multi-country backtest serves two purposes.

- First, it helps identify the particular market where a strategy works best so we can focus our subsequent research there.

- Second, it helps validate a trading idea by demonstrating how widely it applies. A backtest that performs well across several global markets is more robust than one tested on a single market. Even if we subsequently narrow our focus to the most promising market, the strategy's performance in other markets can bolster or weaken our confidence in the trading idea's validity.

The impact of short sale constraints

Among the countries tested above, Japan seemed the most promising market for the "dead cat drop" strategy. Next I run a more realistic, out-of-sample backtest on Japan.

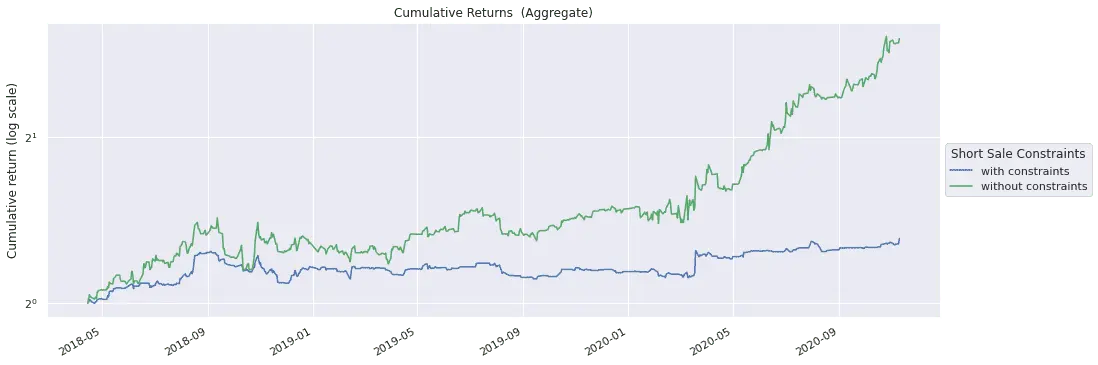

In addition to modeling commissions, I also test the impact of short sale constraints. So far we have assumed that we can sell short any stock we want, but this is not the case. We can only sell short if our broker has shares to loan us. QuantRocket maintains a store of short sale data from Interactive Brokers dating back to 2018, which provides the number of shares available to short for any given security at any given time. I use this dataset to compare the strategy's performance with and without short sale constraints:

Although both variants of the strategy are profitable, short sale constraints significantly reduce the strategy's profits.

Conclusion

Stocks that drop 10% in a single day enjoy a "dead cat bounce" overnight but suffer a "dead cat drop" the next day. While SEC Rule 201 makes it hard to short these stocks in the US market, the same tendency to keep falling exists in international markets and can potentially be exploited there.

Finding profitable strategies requires identifying the markets whose unique characteristics are best suited to the application of your trading idea. Traders searching for alpha should not limit themselves to the US market but expand their search as widely as possible.

Explore this research on your own

This research was created with QuantRocket. Clone the dead-cat-drop repository to get the code and perform your own analysis.

quantrocket codeload clone 'dead-cat-drop' Send a Message

Send a Message