The Best Global Stock Markets for Short Sellers

Tue Jan 01 2019 by Brian StanleyIf you're a short seller exploring global markets, a good first question to ask is: are there shares available to borrow? This post looks at the percentage of stocks that are shortable through Interactive Brokers in each of 17 countries.

Data source

Interactive Brokers provides an FTP site with a list of all shortable stocks and the number of shortable shares available for each, organized by country. The list is updated every 15 minutes throughout the day. QuantRocket maintains a historical archive of the data going back to April 2018.

Methodology

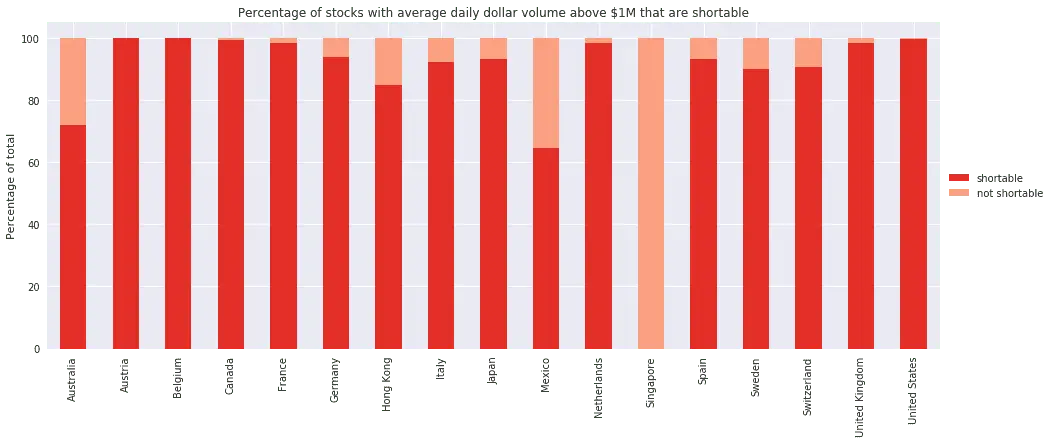

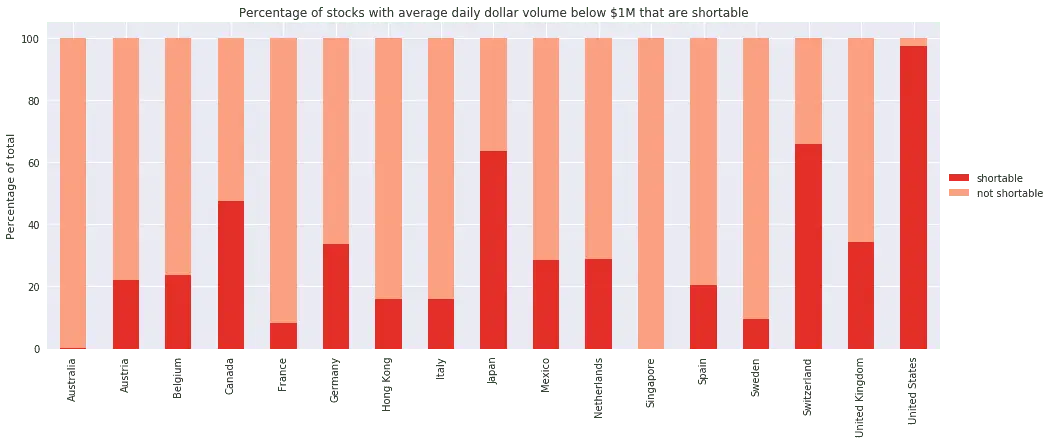

I compare the number of stocks that were shortable in the previous 90 days with the total number of stocks listed. I analyze liquid and illiquid stocks separately, defining liquid stocks as having average daily dollar volume above $1M USD over the 90 day period.

I count stocks as shortable if they had any shares available at any time in the 90-day period, regardless of the quantity of shares and regardless if there were times when no shares were available.

Shorting liquid stocks

The news is good for shorting liquid stocks. In most countries the percentage of shortable stocks is above 80-90%. Singapore is the only country with no shortable shares, while Mexico and Australia are the only other countries where less than 80% of liquid stocks are shortable.

Shorting illiquid stocks

Shorting illiquid stocks is considerably harder. As these stocks trade less, it's understandable that Interactive Brokers has fewer shares to lend out. The United States stands out as the best bet for strategies that short illiquid stocks. The next best bet is Japan, a large exchange where more than 60% of illiquid stocks are shortable. In Switzerland a comparable percentage of illiquid stocks is shortable, though Switzerland has considerably fewer listings than the US or Japan.

Conclusion

For shorting liquid stocks, traders should ignore Singapore but will otherwise find that Interactive Brokers has a reasonably good inventory of shares to lend out in most countries. For shorting illiquid stocks, traders should focus on the United States and Japan.

Explore this research on your own

This research was created with QuantRocket. Clone the global-market-profiles repository to get the code and perform your own analysis.

quantrocket codeload clone 'global-market-profiles' Send a Message

Send a Message