software for

data-driven traders

The backtesting or analysis library that's right for you depends on the style of your trading strategies. End of day or intraday? 8 symbols, or 8000? Event-driven or factor-based? QuantRocket supports multiple open-source Python backtesting and analysis libraries, allowing you to fit the right tool to the job.

The popular backtester that originally powered Quantopian

Key features:

import zipline.api as algo

def initialize(context: algo.Context):

context.assets_to_buy = []

# Rebalance every day, 30 minutes before market close.

algo.schedule_function(

rebalance,

algo.date_rules.every_day(),

algo.time_rules.market_close(minutes=30),

)

def rebalance(context: algo.Context, data: algo.BarData):

positions = context.portfolio.positions

# Exit positions we no longer want to hold

for asset, position in positions.items():

if asset not in context.assets_to_buy:

algo.order_target_value(asset, 0, style=MarketOrder())

...

See Zipline code examples or read the Zipline docs

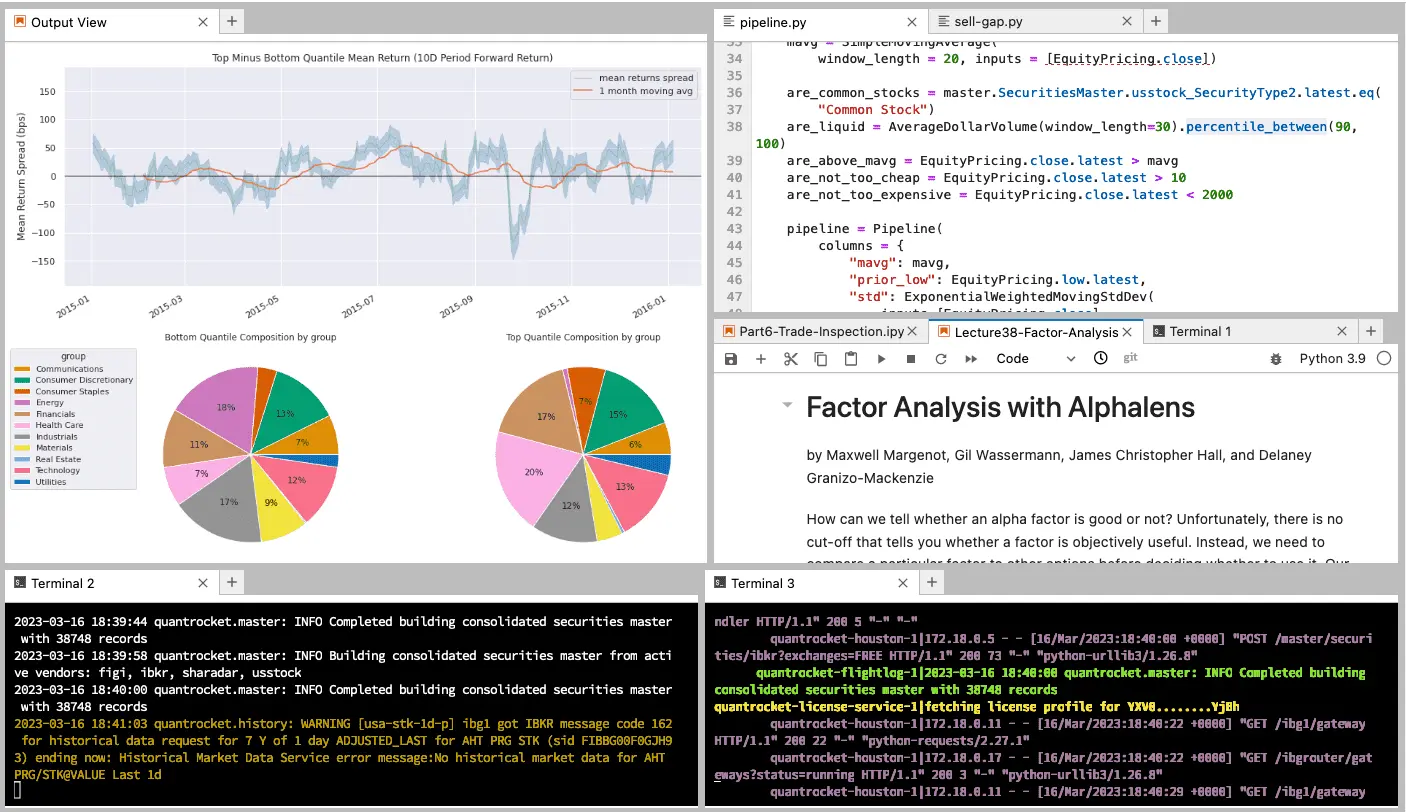

Screen and analyze large universes of securities with Pipeline

Key features:

from zipline.pipeline import sharadar

# trailing-twelve month fundamentals

fundamentals = sharadar.Fundamentals.slice("ART")

# create a universe of the top 50% of stocks by market cap

# that also pay dividends

liquid_stocks = fundamentals.MARKETCAP.latest.percentile_between(50, 100)

pay_dividends = fundamentals.DIVYIELD.latest > 0

universe = liquid_stocks & pay_dividends

# Select the cheapest 100 stocks by enterprise multiple from among

# the universe of liquid, dividend-paying stocks

enterprise_multiple = fundamentals.EVEBITDA.latest

stocks_to_buy = enterprise_multiple.bottom(100, mask=universe)

See Pipeline code examples or read the Pipeline docs

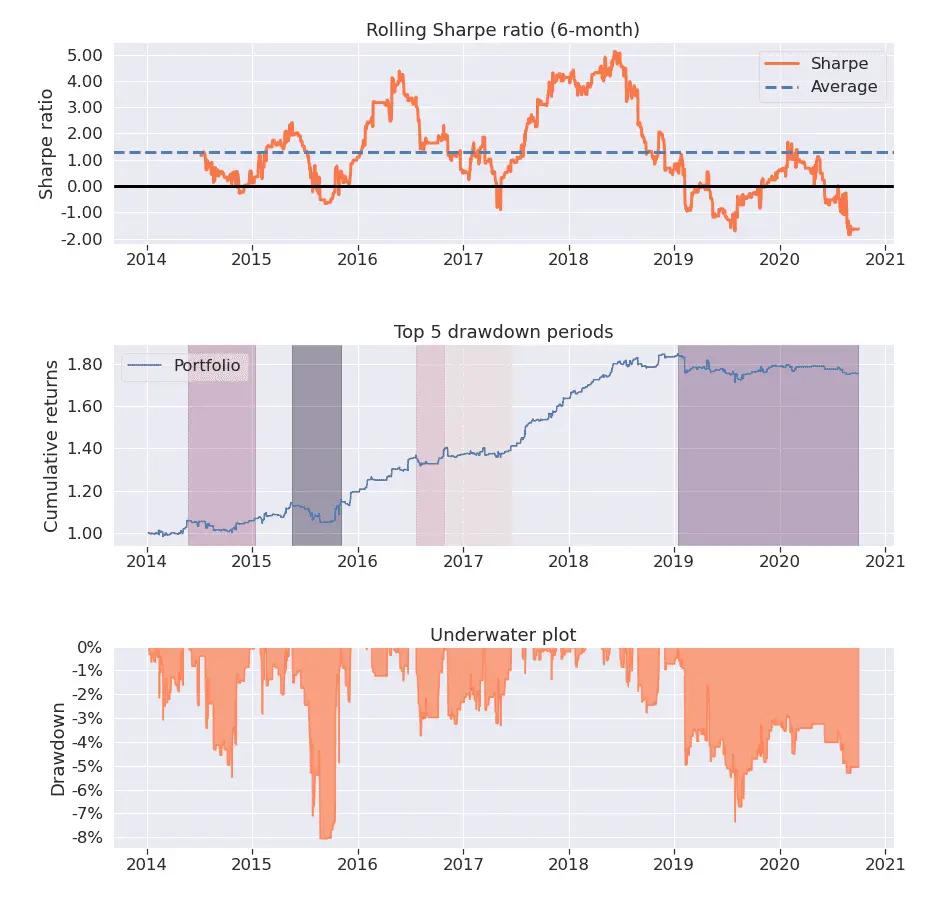

Quickly analyze the predictive value of alpha factors with Alphalens

Key features:

See Alphalens code examples or read the Alphalens docs

Moonshot is the backtester for data scientists

Key features:

import pandas as pd

from moonshot import Moonshot

class MovingAverageStrategy(Moonshot):

CODE = "demo-50ma"

DB = "demo-stk-1d"

def prices_to_signals(self, prices: pd.DataFrame):

# Buy when the close is above the 50-period moving average.

closes = prices.loc["Close"]

mavgs = closes.rolling(50).mean()

signals = closes > mavgs.shift()

return signals.astype(int)

See Moonshot code examples or read the Moonshot docs

First class support for machine learning strategies with MoonshotML

Key features:

import pandas as pd

from moonshot import MoonshotML

class DemoMLStrategy(MoonshotML):

CODE = "demo-ml"

DB = "demo-stk-1d"

def prices_to_features(self, prices: pd.DataFrame):

closes = prices.loc["Close"]

features = {}

# use past returns...

features["returns_1d"]= closes.pct_change()

# ...to predict next day returns

targets = closes.pct_change().shift(-1)

return features, targets

def predictions_to_signals(self, predictions: pd.DataFrame, prices: pd.DataFrame):

# buy when the model predicts a positive return

signals = predictions > 0

return signals.astype(int)

See MoonshotML code examples or read the machine learning docs

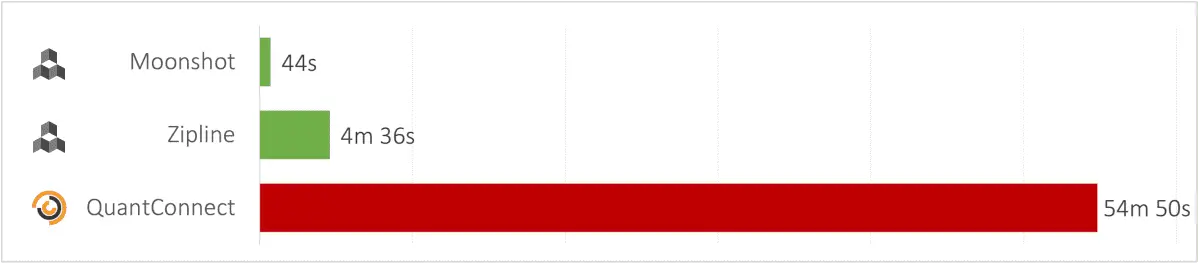

QuantRocket backtests run up to 75x faster than QuantConnect for data-intensive strategies.

Source: "Why Backtests Run Fast or Slow: A Comparison of Zipline, Moonshot, and Lean"

Source: "Why Backtests Run Fast or Slow: A Comparison of Zipline, Moonshot, and Lean"Most quants spend 80% of their time wrangling data and only 20% doing research.

QuantRocket puts a wealth of global market data at your fingertips so you can focus on analysis.

What will you ask the data?

>>> prices = get_prices('us-stk-1d').loc["Close"]

>>> sectors = get_securities_reindexed_like(prices, fields=["Sector"]).loc["Sector"]

>>> eps = get_sharadar_fundamentals_reindexed_like(prices, fields=["EPS"]).loc["EPS"]

>>> eps.groupby(sectors).mean()>>> prices = get_prices("us-stk-1d").loc["Close"]

>>> borrow_fees = get_ibkr_borrow_fees_reindexed_like(prices)

>>> borrow_fees.where(prices < 1).rank(axis=1)>>> at_close = prices.xs("16:00:00", level="Time")

>>> near_close = prices.xs("15:30:00", level="Time")

>>> is_up_for_session = (near_close - at_close.shift()) / at_close.shift()

>>> last_half_hour_returns = (at_close - near_close) / near_close

>>> last_half_hour_returns.where(is_up_for_session)>>> cl_prices = get_prices("cl-fut-1min", times="14:00:00").loc["Close"]

>>> gold_prices = get_prices("us-stk-1d", sids="FIBBG000CRF6Q8").loc["Close"]

>>> contract_nums = get_contract_nums_reindexed_like(cl_prices, limit=2)

>>> month_1_prices = cl_prices.where(contract_nums==1).mean(axis=1)

>>> month_2_prices = cl_prices.where(contract_nums==2).mean(axis=1)

>>> cl_in_contango = month_2_prices > month_1_prices

>>> gold_prices.where(cl_in_contango)Find your data in the Data Library

The search for alpha often takes you down highly individualized paths that result in unique requirements for your strategies. Customization can be essential to getting a quant platform to do what you want.

QuantRocket has an open architecture that runs on Docker and uses JupyterLab as its user interface, making it extremely flexible and extensible. You can run custom scripts to collect data from an alternative data source or calculate custom indicators. You have complete access to the environment and filesystem just as you would with a custom-built system.

Hosted platforms can't offer the same flexibility. If a hosted platform doesn't offer a dial or button that does what you want, you're stuck.

Custom requirements often aren't apparent at first but arise as you get deeper into your research and trading. This makes it risky to adopt a platform that doesn't support extensive customization.

Extend QuantRocket with custom scripts

A simple custom script:

# /codeload/scripts.py

def alert_canceled():

"""Alert if any orders were cancelled today."""

today = pd.Timestamp.today().date()

f = io.StringIO()

download_order_statuses(f, start_date=today)

orders = pd.read_csv(f)

cancelled_orders = orders[orders.Status=="Cancelled"]

for line in cancelled_orders.to_string().splitlines():

logger.warning(line)Schedule it to run daily after the close:

30 16 * * mon-fri quantrocket satellite exec 'codeload.scripts.alert_canceled'A few examples of what's possible:

See a complete example or read the custom scripts docs

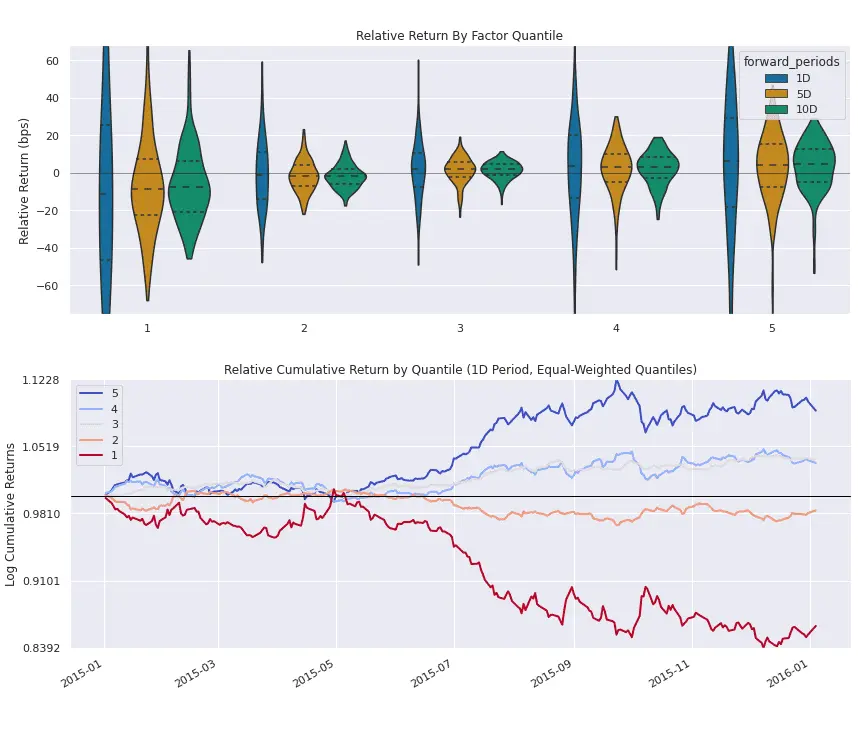

QuantRocket's home base is JupyterLab, the IDE of choice for data scientists. (VS Code is also supported.)

Comprehensive hover documentation with auto-complete is available for all of QuantRocket's APIs.

Real-time market data, powered by your choice of provider.

An intuitive API with a flexible feature set, powered by QuantRocket.

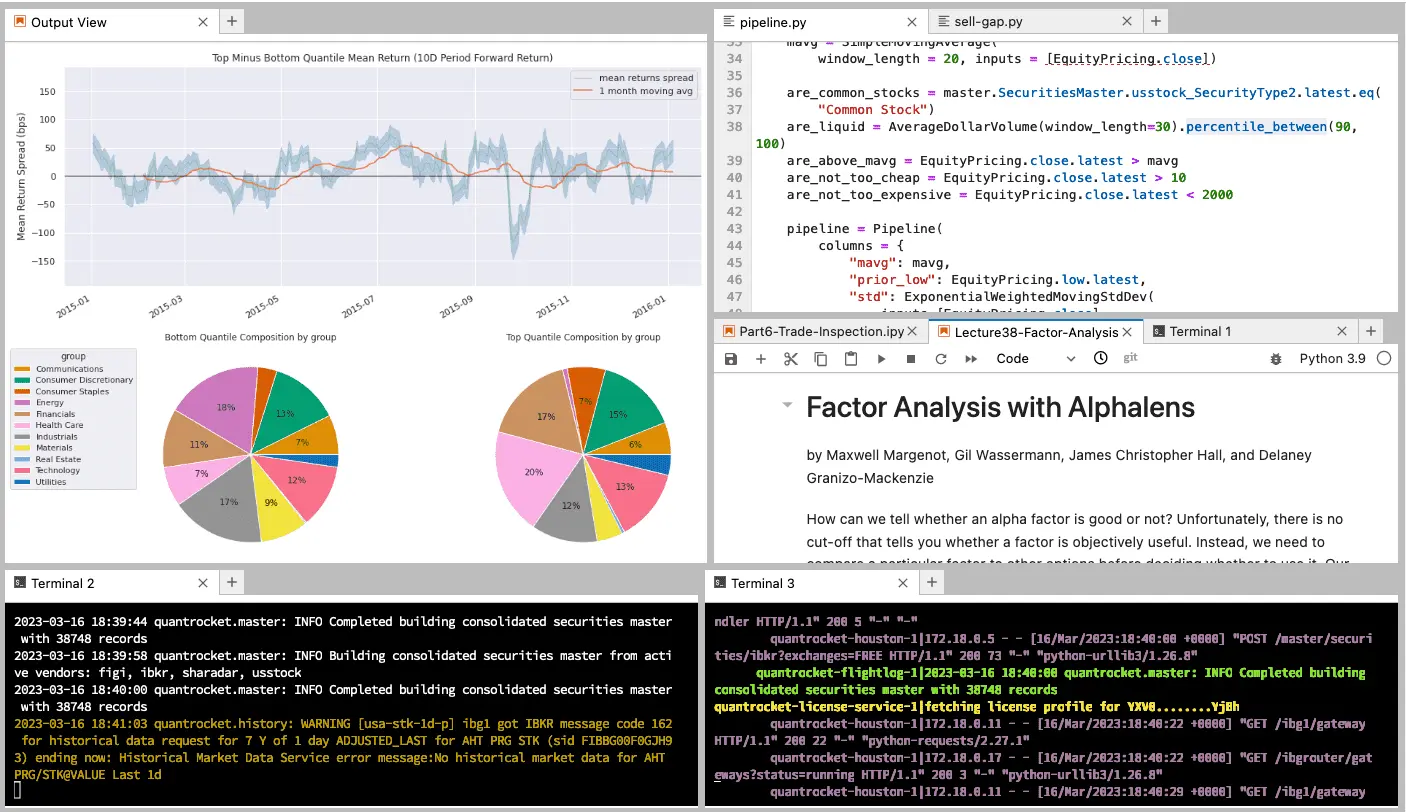

Backtesting is only the first step. Once you go live, you need a clear picture of performance to assess whether live trading is mirroring your backtest.

Find more example strategies in the Code Library