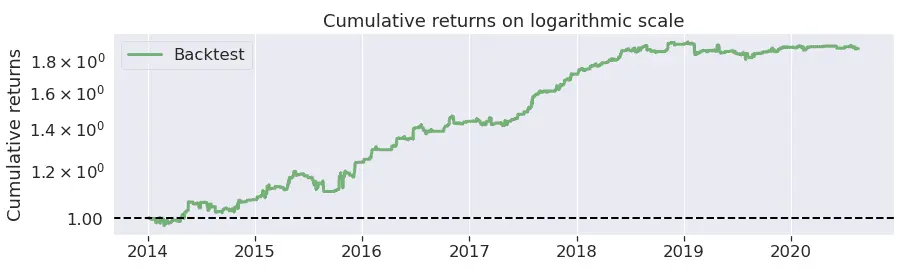

What happens when strong stocks gap down at the open? A well-known trading strategy is to buy the gap, expecting mean reversion. This post uses Zipline to explore down gaps and finds a profitable strategy based on selling, not buying, the gap.

What happens when strong stocks gap down at the open? A well-known trading strategy is to buy the gap, expecting mean reversion. This post uses Zipline to explore down gaps and finds a profitable strategy based on selling, not buying, the gap.

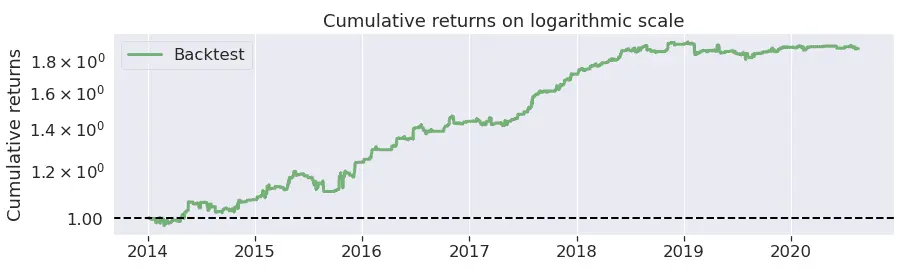

Intraday trading strategies offer great promise as well as great peril. This post explores an intraday trading strategy for crude oil calendar spreads and highlights the impact of transaction costs on its profitability.

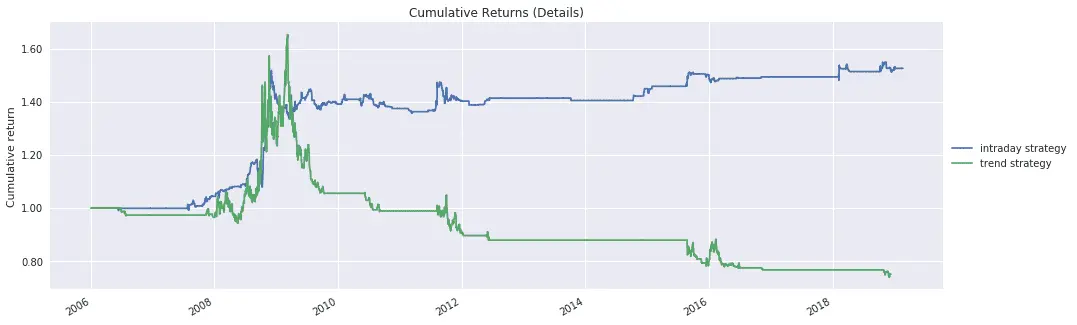

Do intraday strategies have a place in the portfolios of long-term investors and fund managers? This post explores an intraday strategy that works best in high volatility regimes and thus makes an attractive candidate for hedging long-term portfolio risk.

Does forced buying and selling of underlying shares by leveraged ETF sponsors cause predictable intraday price moves? This post explores an intraday momentum strategy based on the premise that it does.

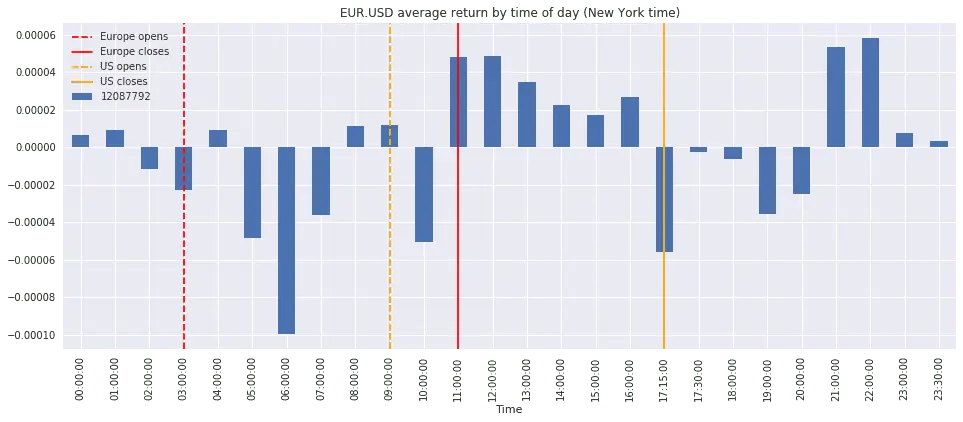

Do businesses exchange currencies in predictable ways that FX traders can exploit? This post explores an intraday EUR.USD strategy based on the hypothesis that businesses cause currencies to depreciate during local business hours and appreciate during foreign business hours.