The Most Volatile Stock Markets in the World

Sun Jan 13 2019 by Brian StanleyMany quantitative trading strategies thrive in high volatility regimes, while other trading strategies work best in low volatility regimes. So which global markets are the most and least volatile? This post compares the daily, overnight, and intraday volatility of 17 countries.

Methodology

Using historical data from Interactive Brokers, I calculate the standard deviation of daily (close-to-close), overnight (close-to-open), and intraday (open-to-close) returns for 2018 for every stock in each of 17 countries and take the average for each country.

I analyze liquid and illiquid stocks separately, defining liquid stocks as having average daily dollar volume above $1M USD.

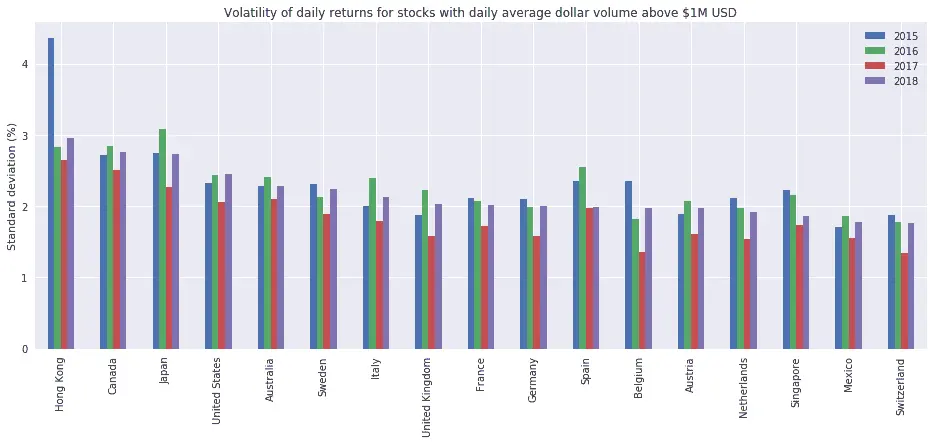

To gauge whether volatility is a persistent characteristic of particular countries, I compare the standard deviation of daily returns for each year from 2015 to 2018.

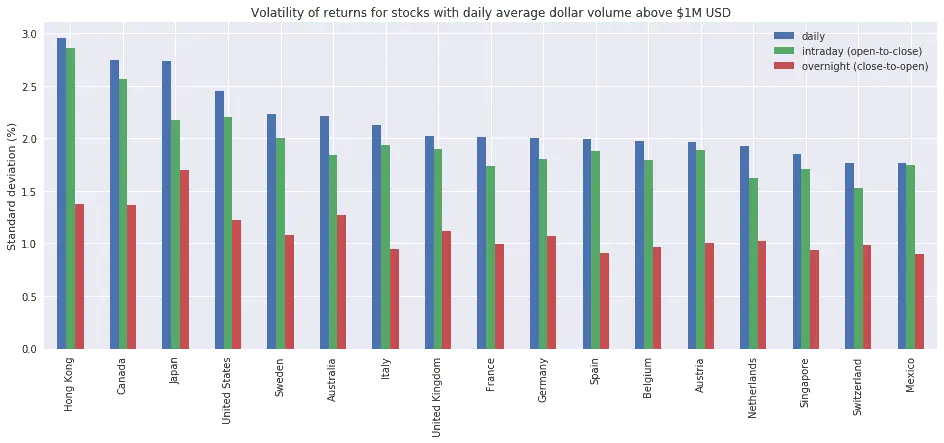

Liquid stocks: most and least volatile markets

For liquid stocks, the top 3 most volatile markets in 2018 were Hong Kong, Canada, and Japan. Daily and intraday returns were most volatile in Hong Kong, while overnight returns were most volatile in Japan.

Across all countries, overnight returns are considerably less volatile than intraday returns.

Think emerging markets are volatile? Mexico was the least volatile market in 2018.

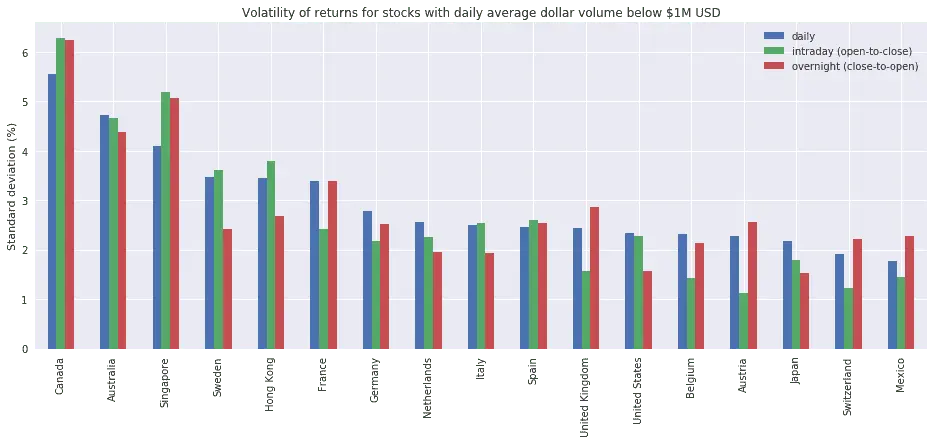

Illiquid stocks: most and least volatile markets

For illiquid stocks, the two most volatile markets of 2018 were Canada and Australia (two countries with a large proportion of basic materials stocks). Singapore, among the least volatile markets in 2018 for liquid stocks, was the third most volatile market for illiquid stocks. Mexico again ranks as the least volatile market of 2018.

Does volatility persist?

How volatile is volatility? Next we compare the volatility of daily returns for each year from 2015 to 2018, to see if volatile markets remain volatile:

While volatility fluctuates from year to year (with 2017 being a year of below average volatility), Hong Kong, Japan, and Canada traded places in each of the last 4 years as the top 3 most volatile markets. (Note the spike in volatility in Hong Kong in 2015, the year of the stock market bubble in mainland China.)

| 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|

| 1st | Hong Kong | Japan | Hong Kong | Hong Kong |

| 2nd | Japan | Canada | Canada | Canada |

| 3rd | Canada | Hong Kong | Japan | Japan |

Conclusion

Understanding market characteristics can increase your research efficiency by helping you identify the most promising markets for your trading strategies. Traders whose strategies depend on volatility should consider Hong Kong, Japan, and Canada. Trading strategies which benefit from low volatility will find greener pastures elsewhere.

Explore this research on your own

This research was created with QuantRocket. Clone the global-market-profiles repository to get the code and perform your own analysis.

quantrocket codeload clone 'global-market-profiles' Send a Message

Send a Message